FCF: Common Language of AI and Valuation

How Free Cash Flow Bridges Intrinsic Value and Predictive Power

Disclaimer: As a freelance analyst, my posts exclusively cover the AI methodologies of Portfolio123 (P123), without addressing individual stock recommendations.

This Post is included in Section 3: Choosing the Right Features.

The table of contents is as follows:

Why Is FCF So Powerful?

In the world of fundamental analysis, Free Cash Flow (FCF) is a staple concept. Yet, curiously, it doesn’t appear in GAAP financial statements. It requires a specific calculation.

And still—when we train machine learning models to forecast stock returns—FCF-based features consistently rise to the top.

Why would AI, with no understanding of accounting rules or corporate strategy, treat FCF as one of the most important signals in equity prediction?

One possible answer: FCF is future-oriented, as we see it in DCF method.

It doesn’t just reflect what a company has done—it reveals what a company can do next.

In the experiment in a previous post, we found the top two and three of the top five features were Free Cash Flow metrics.

There are three key reasons why FCF works so well, especially in machine learning–driven investment strategies:

1. FCF is a Proxy for Future Optionality

Free Cash Flow is what’s left after paying to keep the business running. It’s what the company can use to make strategic decisions—whether that’s paying dividends, buying back shares, paying down debt, or investing for growth.

From an AI model’s perspective, high FCF = future freedom.

It signals flexibility, resilience, and control over destiny.

2. FCF Reflects Economic Reality, Not Just Accounting Profits

Net income is full of non-cash noise: depreciation, amortization, deferred taxes, and accounting assumptions.

FCF, in contrast, reflects real cash movement and economic efficiency. AI models learn—purely from data—that companies generating more free cash tend to outperform.

AI doesn’t care about definitions—it cares about what works.

3. FCF Predicts Without Needing Forecasts

FCF’s value comes from what the company can do next. But AI models don’t need to model that future explicitly.

They don’t forecast—they learn the empirical correlation between today’s free cash flow and future returns.

The DCF Connection

This isn’t just about predictive modeling. In traditional valuation theory, Free Cash Flow is the core input of the DCF (Discounted Cash Flow) method, one of the most widely used tools in finance.

EV: Enterprise Value

FCFt: Free Cash Flow in period t

WACC: Weighted Average Cost of Capital

t: Time period (years)

n: Final year of the explicit forecast period

TV: Terminal Value

DCF tells us that the value of a company = the present value of all future FCFs.

It’s not just a metric—it is the intrinsic value.

So, even though AI doesn’t run DCF models, when it favors features like FCF / Assets or FCFYield, it is, in essence, discovering DCF logic from empirical return data.

Where Human Intuition and Machine Learning Meet

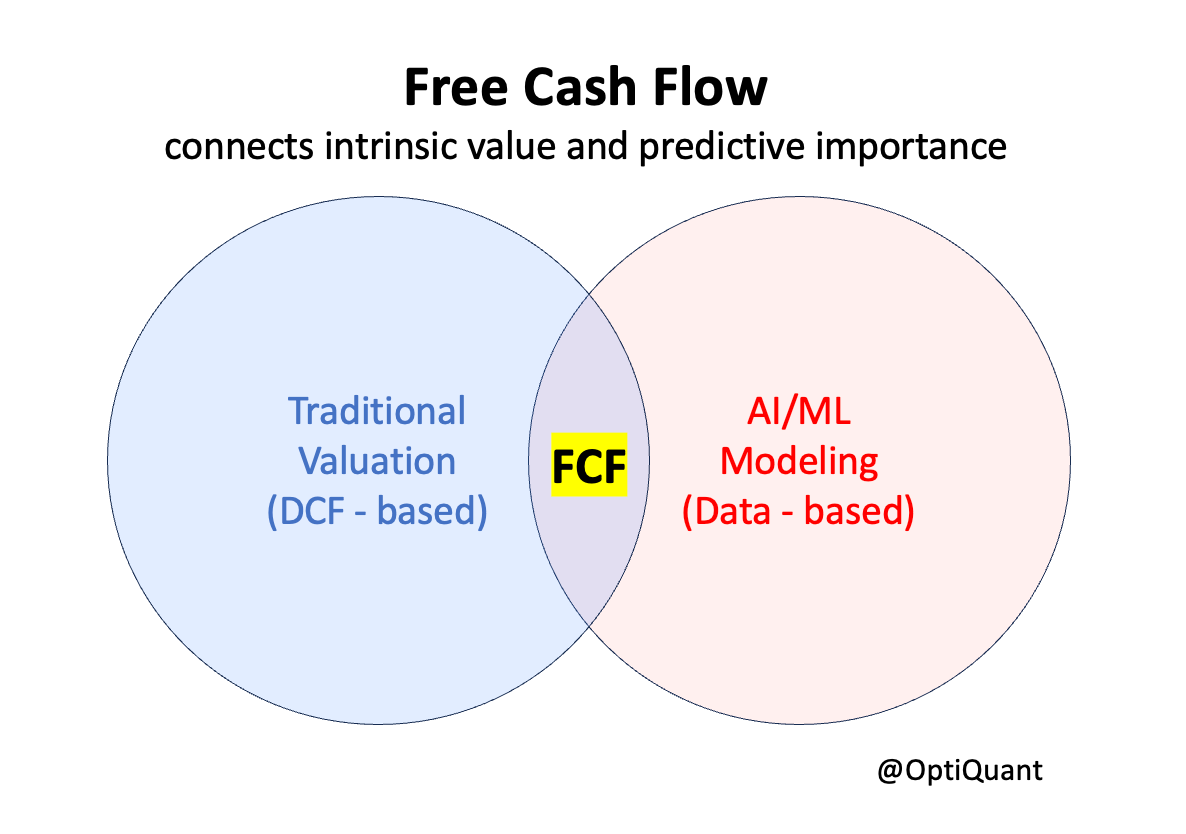

This creates a striking convergence:

Traditional valuation uses FCF to estimate intrinsic value

AI models use FCF to predict market behavior

Both agree: FCF is the signal that matters

The diagram below illustrates this convergence.

Final Thoughts

FCF is non-GAAP and requires a specific calculation.

But it works.

And that’s what matters.

Free Cash Flow is the common language between value investors and AI quants.

Not because it forecasts the future—but because it enables it.

When building your next model—or your next investment thesis—don’t overlook FCF.

AI certainly won’t.

Interested in building your own AI strategies with Portfolio123?

You can sign up for a trial of Portfolio123 here (affiliate link).

This perfectly captures why FCF is more than an accounting metric - it's the operational bridge between human intuition and machine learning. Exactly the kind of insight we feature in The Efficiency Playbook.